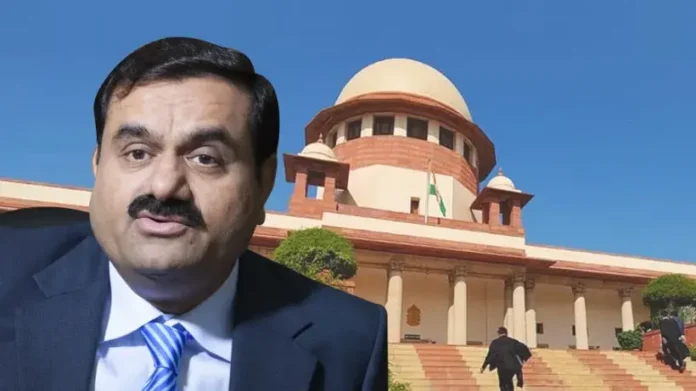

New Delhi [India], January 27 : The Supreme Court on Monday dismissed an application filed by advocate Vishal Tiwari, challenging the apex court’s Registrar order dated August 5, 2024. The order had declined to register his earlier application concerning the Hindenburg-Adani Group matter.

A bench led by Justice JB Pardiwala rejected Tiwari’s application, which sought to compel the Securities and Exchange Board of India (SEBI) to submit its final investigation report on the allegations made by Hindenburg Research against the Adani Group.

The Registrar had previously refused to accept Tiwari’s miscellaneous application, stating that it did not present a reasonable cause. In his application to the Supreme Court, Tiwari sought the court’s intervention to direct the Registry to register his application for further consideration.

Tiwari argued that due to the ongoing Hindenburg controversy, it was essential for SEBI to conclude its investigation and make its findings public. He requested that the appeal be allowed and that the Registry be instructed to register the application for a proper hearing.

The petition further stated that the Registrar’s refusal to register the application under Order XV Rule 5 of the Supreme Court Rules 2013 violated the petitioner’s fundamental rights and effectively closed the court’s doors to him.

Tiwari also contended that the Registrar’s decision contradicted a Supreme Court order from January 3, 2024, which had set a three-month timeline for SEBI’s investigation into the allegations. He argued that the term “preferably” used in the order should not be interpreted to mean there was no fixed timeline, as a specific three-month period had been established.

The petition highlighted that despite SEBI dismissing the Hindenburg allegations as baseless and the Supreme Court ruling that third-party reports could not be considered, these events had created public and investor uncertainty. Tiwari emphasized that in light of these circumstances, it was crucial for SEBI to complete the investigation and release its findings.

Hindenburg had previously alleged that 18 months after its initial report on the Adani Group, SEBI had shown a “surprising lack of interest” in probing the alleged offshore shell companies linked to the group. The allegations included claims that these entities were used for round-tripping funds and inflating stock prices, with further accusations that SEBI’s chairperson and her husband were linked to these entities.