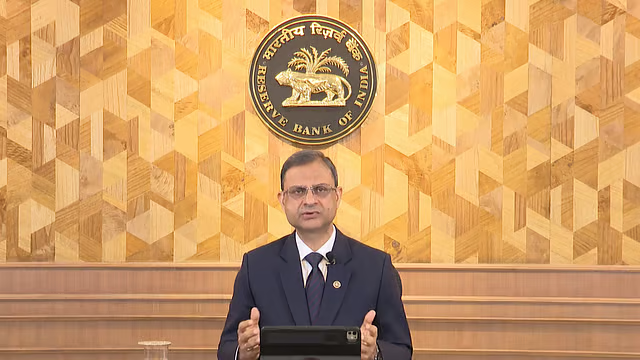

The Reserve Bank of India (RBI) has chosen to maintain a status quo on its key interest rate and keep its monetary policy stance neutral. This decision was announced by RBI Governor Sanjay Malhotra on Wednesday following the bi-monthly meeting of the Monetary Policy Committee (MPC).

The MPC voted unanimously to keep the repo rate steady at 5.5%. This move came despite the fact that 24 out of 39 economists surveyed by Bloomberg News had already anticipated the status quo, while the rest had hoped for a quarter-point rate reduction. The central bank had previously lowered rates by a total of 100 basis points earlier in the year.

Improving Economic Outlook and External Risks

The RBI’s decision to pause comes alongside a significantly improved outlook for the Indian economy, despite external pressures.

- GDP Growth: The RBI has revised India’s GDP growth forecast for FY26 higher to 6.8%, up from the earlier projection of 6.5%. This revision follows the Indian economy’s stronger-than-expected growth of 7.8% in the April-June quarter.

- Inflation Rate: The central bank has also lowered its inflation rate forecast for FY26 to 2.6%, down from 3.1% earlier. The recent GST rate cuts by the government are expected to have a “sobering impact on inflation, while stimulating consumption and growth,” according to Governor Malhotra.

Governor Malhotra noted that the economic outlook “remains resilient due to favourable monsoon, lower inflation and monetary easing.” He added that “Domestic economic activity continues to sustain momentum in the second quarter of this fiscal.”

External Headwinds and Policy Balancing Act

The MPC is currently trying to balance two competing priorities: subdued domestic inflation and the risk to growth posed by high external tariffs.

- US Tariffs: The higher 50% tariffs imposed by US President Donald Trump are weighing on India’s growth prospects, prompting a sell-off in local stocks by foreign investors. The RBI governor acknowledged that “tariff-related development is likely to decelerate growth in the second half of the fiscal,” though he believes that “GST and other reforms will offset impact of external factors on economic growth to some extent.”

- Rupee Slide: The RBI is also juggling the rupee’s record slide; it’s down 3.6% against the dollar this year, making it the worst performer among Asian emerging peers.

Governor Malhotra concluded that the Reserve Bank will remain vigilant and “towards incoming macroeconomic data for deciding next course of action.”