NEW DELHI — In a major development for Indian consumers, the government’s new Goods and Services Tax (GST) reforms officially came into effect on Monday, September 22. The new framework introduces a simplified two-tier tax structure and, most notably, a zero-tax slab for several essential goods and services.

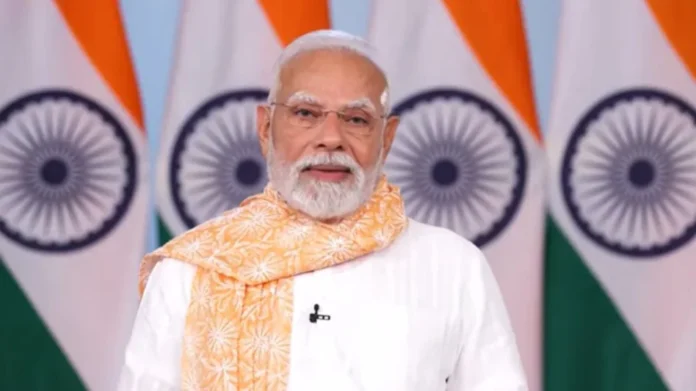

During an address to the nation on Sunday evening, Prime Minister Narendra Modi announced that the combined effect of these GST changes and earlier income tax reforms is projected to save Indian citizens approximately ₹2.5 lakh crore.

The new tax structure, approved by the GST Council on September 3, simplifies the previous four-slab system. The 12% and 28% slabs have been eliminated, with most items now falling under either the 5% or 18% tax rate. A new 40% levy has been introduced for ultra-luxury items, while tobacco and related products will remain in the 28% slab with an additional cess.

List of Items with Zero Tax (0% GST)

The reforms provide significant relief to households by making a number of crucial items completely tax-free. Here is a list of some of the key items that will now have a zero GST rate:

- Food Items:

- Ultra-High Temperature (UHT) milk

- Pizza bread

- Prepackaged and labeled chena or paneer

- Khakhra, chapati, roti, paratha, and parotta

- Insurance:

- All individual health and life insurance policies, including reinsurance

- Life-Saving Drugs and Medicines:

- 33 specific life-saving drugs and medicines, including three used to treat cancer, rare diseases, and other serious chronic conditions

- School and Office Stationery:

- Erasers

- Uncoated paper and paperboard used for exercise books, notebooks, graph books, and laboratory books

- Maps, hydrographic or similar charts, atlases, globes, and topographical plans

- Pencil sharpeners, pencils, crayons, pastels, and chalk sticks

This move is expected to have a broad impact on the Indian economy, reducing the financial burden on consumers and simplifying the tax compliance process for businesses.