New Delhi, India — Following Prime Minister Narendra Modi’s address on the upcoming Goods and Services Tax (GST) reforms, the Congress party launched a sharp criticism on Sunday, labeling the current changes as inadequate and arguing that the GST regime, in its current form, remains a “Growth-Suppressing Tax.”

In a post on X, Congress leader Jairam Ramesh questioned the Prime Minister’s claim of “sole ownership” over the amendments, reminding the public that the changes were decided by the GST Council, a constitutional body.

Ramesh reiterated the Congress party’s long-standing position that the GST system is flawed. He pointed to several issues:

- A high number of tax brackets.

- “Punitive” tax rates on items of mass consumption.

- Large-scale evasion and misclassification of goods.

- High compliance costs, which particularly burden small businesses.

- An “inverted duty structure” that discourages output.

The Congress leader stated that his party has been demanding a more comprehensive “GST 2.0” since July 2017, a pledge that was also a key part of their 2024 Lok Sabha election manifesto.

Concerns Over MSMEs, States, and Economic Growth

Jairam Ramesh detailed several outstanding issues that he believes the current reforms fail to address. He stressed the need to meaningfully address the concerns of MSMEs, which are major employment generators. This includes increasing the thresholds for interstate supplies to ease their burden.

Furthermore, he called for a resolution of sectoral issues that have emerged in industries such as textiles, tourism, and handicrafts. He also urged the government to incentivize states to bring sectors like electricity, alcohol, petroleum, and real estate under the GST framework.

A significant point of contention raised by Ramesh is the unaddressed demand from states for a five-year extension of the GST compensation to fully protect their revenues, a demand he described as being in the “true spirit of cooperative federalism.”

Ramesh also expressed skepticism about whether the reforms, which he noted were “delayed by 8 years,” would actually stimulate private investment and boost India’s GDP growth. He pointed to India’s rising trade deficit with China, which has doubled to over $100 billion in the last five years, and warned that Indian businesses are struggling under “oligopolistic pressures,” forcing many entrepreneurs to relocate abroad.

PM Modi’s “GST Bachat Utsav”

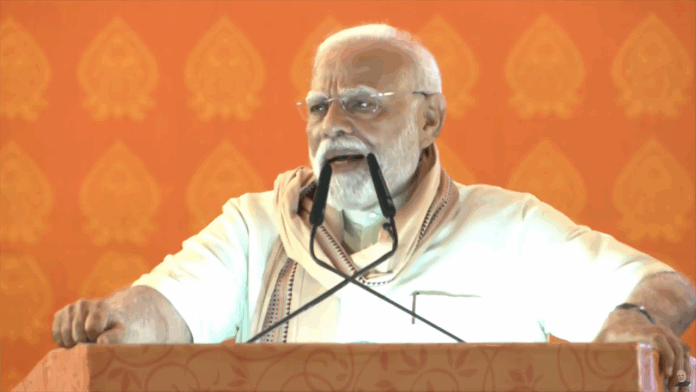

Earlier in the day, Prime Minister Modi announced the implementation of the “Next-Generation GST Reforms” from September 22, the first day of Navratri. He hailed the changes as a major step toward a self-reliant India and declared the beginning of a nationwide “GST Bachat Utsav” (GST Savings Festival).

According to the Prime Minister, the reforms would largely consolidate the tax structure into two main slabs of 5% and 18%, making everyday goods cheaper and benefiting the poor, middle-class, and entrepreneurs. He called the reforms a “festive gift” that would accelerate India’s growth story and make business easier.